Many UK drivers expect fuel prices to fall soon after wholesale costs come down. When that doesn’t happen, it often feels unfair or confusing. So how quickly should petrol prices fall — and why doesn’t it always work that way?

Recent monitoring by the Competition and Markets Authority (CMA) helps explain the gap between what drivers expect and what actually happens at the pump.

What “wholesale fuel costs” actually mean

Wholesale fuel costs reflect what retailers pay for fuel before it reaches the forecourt. These costs are influenced by:

- Global oil prices

- Refining and distribution

- Exchange rates

- Taxes and logistics

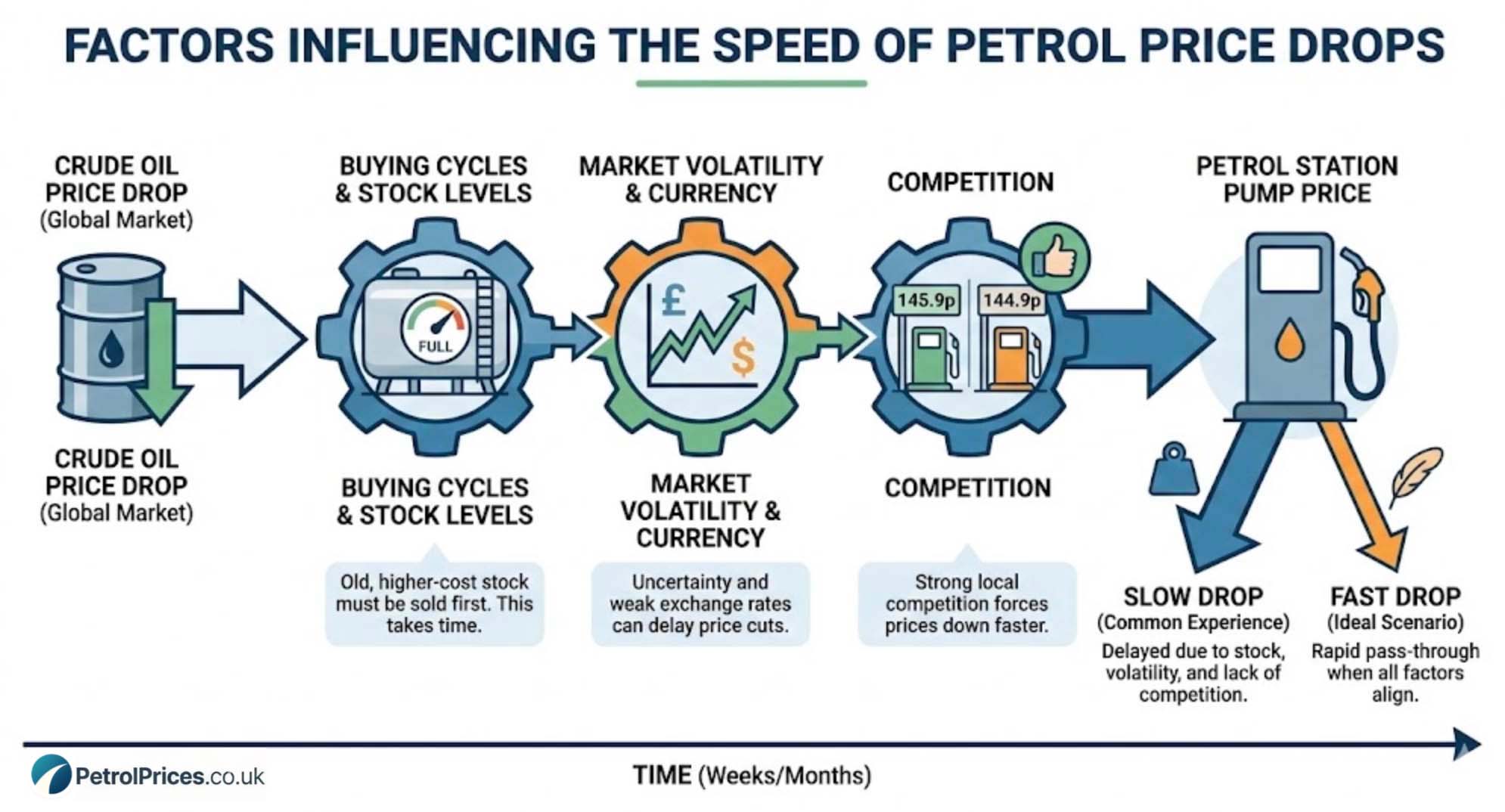

Wholesale prices can move daily — sometimes sharply — but that doesn’t mean pump prices change at the same pace.

The simple expectation vs the real world

In an ideal, highly competitive market, rising wholesale costs would be reflected quickly in pump prices, and falling wholesale costs would be passed on just as quickly.

In reality, pump prices tend to rise fast but fall slowly. This pattern has become a familiar feature of fuel pricing in the UK.

Why prices rise faster than they fall

There are several reasons why pump prices respond more slowly when costs fall:

- Retailers protect their margins: When costs increase, retailers move quickly to avoid selling fuel at a loss. When costs fall, there is less urgency to reduce prices immediately.

- Competition varies by location: In areas with limited choice, stations face less pressure to cut prices quickly. Where competition is stronger, prices tend to fall sooner.

- Price changes aren’t automatic: Retailers set prices manually or through pricing systems. Changes may happen daily or less frequently, creating delays even when costs drop.

How long is “reasonable”?

There is no fixed legal timeframe for passing on wholesale savings. However, regulators expect price reductions to follow within days, not weeks, when cost changes are sustained.

If wholesale costs fall and remain lower for an extended period, pump prices should reflect that within a relatively short time in a competitive market. When this doesn’t happen, it can indicate weak competitive pressure rather than genuine cost constraints.

Why some stations reduce prices sooner than others

Not all petrol stations behave the same way. Stations that tend to lower prices faster often:

- Face strong local competition

- Rely on fuel volume rather than margins

- Use fuel pricing to attract footfall (common with supermarkets)

Stations that delay price cuts are often in areas where drivers have fewer alternatives.

What this means for drivers in practice

Drivers may notice that:

- One station lowers prices within days

- Another nearby station holds prices steady for much longer

- Price gaps widen before narrowing again

These differences are not accidental — they reflect how competition works locally.

The role of transparency and comparison

When prices fall slowly, drivers who compare prices benefit the most. Comparison tools help identify which stations respond quickly to cost drops and which consistently lag behind.

Over time, stations that delay price cuts risk losing customers — but only if drivers are aware of cheaper alternatives.

Will this improve in the future?

Greater transparency around fuel pricing is expected to encourage quicker price responses when costs fall. When drivers can easily see and compare prices, retailers face more pressure to act.

However, behaviour is unlikely to change overnight. Competition and visibility must both be strong for price movements to become more responsive.

The bottom line

There is no instant rule for how quickly petrol prices should fall when wholesale costs drop — but sustained cost reductions should be reflected at the pump within days in a competitive market. When prices don’t fall as expected, it’s often a sign of weak competition rather than unavoidable costs. For drivers, the most effective response remains the same: compare prices and choose the stations that pass on savings faster.